The KKA team has deep experience as an investor, owner and manager of Mittelstand companies.

In all investments, KKA strives to deliver traditional value creation strategies in conjunction with a repeatable and proprietary Technology Enabled Value-Creation strategy to futureproof existing cashflows and ignite significant growth opportunities.

GeHo Group

GeHo Group is a leading German distributor of confectionery, snacks, and beverages, specializing in the fast-growing vending industry. Founded in 1989, the company has built a strong reputation as a trusted partner for universities, schools, corporations, and public institutions. With a broad portfolio of third-party and private label products, GeHo ensures just-in-time delivery of small-batch orders directly to the point-of-sale, leveraging its lean operations, sophisticated logistics, and high customer density.

Entry year: 2025

Industry: B2B Snack & Beverage Distribution

Fund: KKA Value Fund II

Status: Current investment

BLACKROLL AG

BLACKROLL is a global leader in innovative health, recovery, and movement products. Founded in 2007, the company has established itself internationally with high-quality solutions for fitness, regeneration, and sleep. BLACKROLL’s products are distributed in more than 57 countries and developed in close collaboration with experts in sports science, physiotherapy, and medicine. The main focus is on the DACH region. With the support of KKA Partners and an experienced leadership team, BLACKROLL is pursuing an ambitious growth strategy focused on innovation, digital transformation, and international expansion.

Entry year: 2024

Industry: Therapeutic Health & Recovery Solutions

Fund: KKA Value Fund II

Status: Current investment

Healthcare Holding Schweiz AG

Healthcare Holding Schweiz is a Swiss “Buy, Build & Technologize” Platform for medtech distribution with headquarters in Zug and more than 100 employees. The group was formed in 2021 but some of the individual entities date back as long as the 1950s. The group is a leading player in Switzerland with the mission to offer Swiss patients unconstrained access to the most modern medtech products and services. The offering covers several niches and includes a broad range of products spanning Levels 1-3 of regulated medical products. Next to medical products, HHS provides value-added services such as rental, maintenance and consignment stock. It covers more than 100 brands from renown OEMs, as well as proprietary products.

Entry year: 2024

Industry: Health Care

Fund: KKA Value Fund II

Status: Current investment

Prokuras GmbH

Prokuras is a leading German “Buy, Build & Technologize” platform in the property management sector. Headquartered in Hamburg and employing over 350 people, the group was founded in 2023 and comprises 15 partner companies across Germany. Together, they manage more than 40,000 units. Prokuras aims to become a market leader by leveraging synergies and pursuing both organic and inorganic growth. The group offers property owners a comprehensive range of services from a single source.

Entry year: 2023

Industry: Real Estate Management

Fund: KKA Value Fund II

Status: Current investment

SSF Sales & Service Factory

The renown Cho-Time management team, backed by KKA Partners, takes over SSF Sales & Service Factory GmbH (“SSF”) and the majority of the Cho-Time group companies in Mönchengladbach, Germany.

Through its Cho-Time group, SSF provides bespoke outsourced CRM and sales services with over 1,800 employees in over 15 German and international locations. SSF provides value to its customers via (i) successful issue resolution, (ii) customer acquisition and retention, as well as, (iii) up & cross selling opportunities. The company successfully transforms customer service from a cost center to a revenue driver.

The MBO allows management to focus on digitization and even more employee training & coaching. This in turn ensures growth and continued high quality for existing and new customers in a capacity constrained market.

Entry year: 2022

Industry: Business Services

Fund: KKA Value Fund II

Status: Current investment

CuraMed Clinics Group

The CuraMed Clinics Group, based in Albstadt (Germany), operates private clinics, day clinics and outpatient clinics for psychosomatic medicine, psychiatry and psychotherapy. CuraMed stands for a holistic treatment of patients, combining both psychotherapeutic and somatic elements, especially in the areas of sleep, pain, internal medicine, tinnitus as well as nutrition and supplements. They approach this with new, digital therapy forms.

Entry year: 2021

Industry: Health Care

Fund: KKA Value Fund II

Status: Current investment

Xantaro Group

Xantaro Group, headquartered in Hamburg (Germany), is a leading European service provider for high-performance communication networks, offering design, integration and best-in-class maintenance / operational services. The recently launched software platform Yukon provides customers full transparency over their complex multi-vendor network environments. It improves maintenance / operational processes and identifies optimization potential. The company was founded in 2007 and employs over 160 staff across several locations in Germany and the UK.

Entry year: 2021

Industry: IT Service Provider

Fund: KKA Value Fund II

Status: Current investment

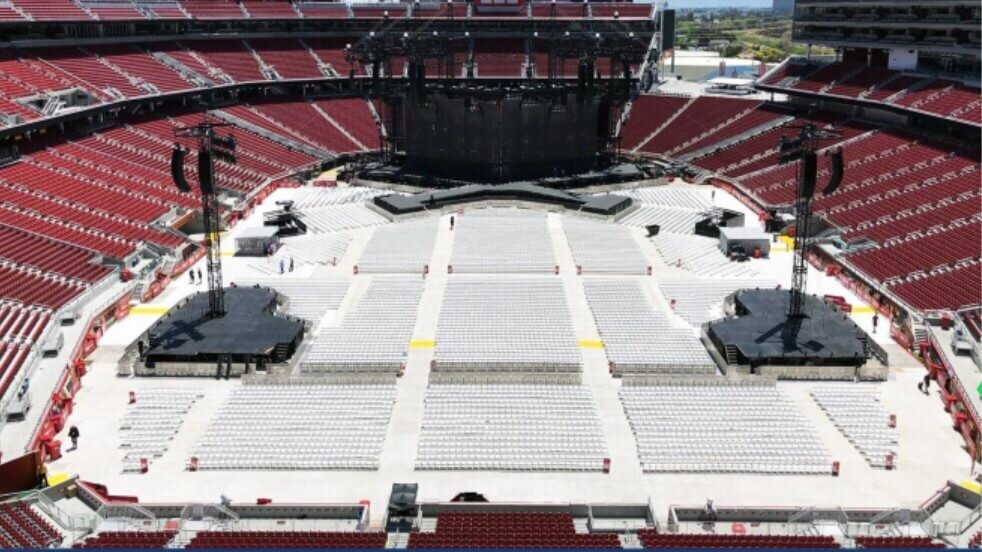

EVAGO Group

Evago Group, based in Pyrbaum (Germany) is a leading live event infrastructure rental company. It services the attractive live events market that has profited from secular growth over the past decade. The business model revolves around the rental of mission-critical infrastructure, such as barriers and floor protection.

Entry year: 2019

Industry: Live entertainment infrastructure

Fund: KKA Seed Fund

Status: Current investment